The New Zealand Seniors Series: Legacy Report 2023

As we enter the prime of our lives, it's only natural to reflect on the legacy we want to create and leave behind. Many Kiwis over 50 are already on this journey of self-discovery, according to our new legacy research. In the midst of recent challenges like COVID-19 and recession, two-thirds (66%) of us are recalibrating our legacy mindsets, with more than a third (36%) finding renewed motivation to provide for loved ones, while close to a quarter (23%) grapple with diminishing confidence in their capacity to offer financial support.

The Legacy Report 2023, based on a survey of more than 500 New Zealanders over the age of 50, reveals nearly half (46%) of us have spent considerable time thinking about the legacy we want to leave behind, and many of us have at least given it some thought (44%).

Most of us believe reflecting on our legacy is a valuable opportunity for personal growth and development (88%). It's not just about leaving a mark on future generations; it's also about discovering what truly matters to us.

It’s heart-warming to know that four-fifths (80%) of our community believe we have already achieved some of our greatest life goals, and more than a quarter (27%) of us are extremely confident that our legacy goals will be fulfilled. On the other hand, a third of us (33%) are still figuring out how to make it happen.

Of course, it’s only natural for our values, priorities, and perspectives to change over time, which would influence the legacy we want to leave behind. According to the study, nearly two-thirds (60%) of us admitted that our legacy goals have evolved with our journey in life, reflecting the impact of new experiences and events.

Financial legacy takes priority amid uncertainty

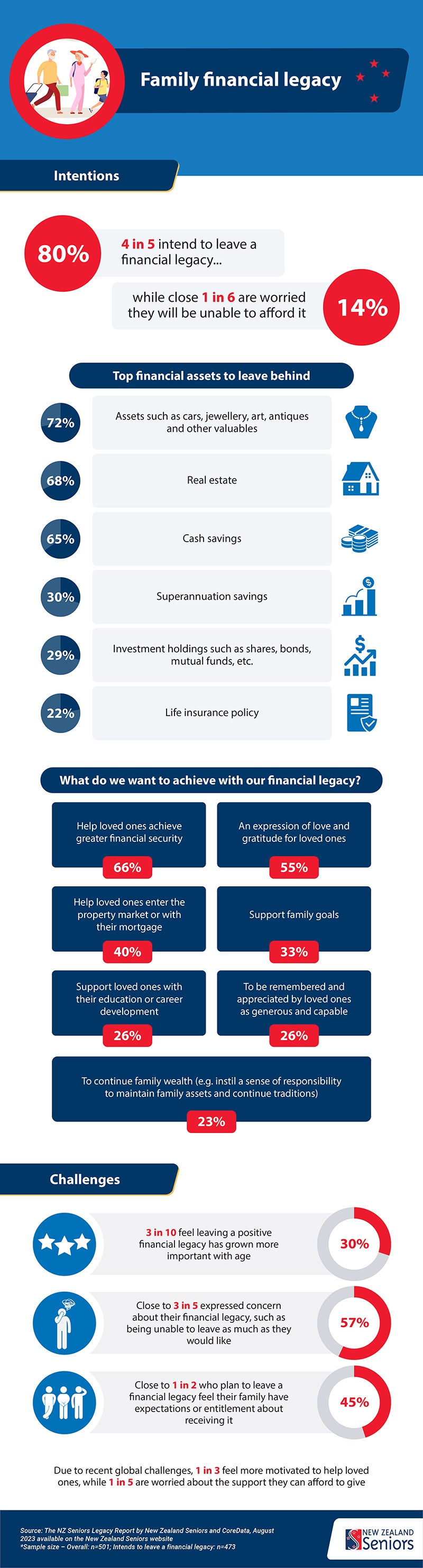

A financial legacy tops the list of what we want to leave behind. In fact, most (80%) of us aspire to leave valuable assets in the hands of loved ones, the most common being personal property (72%), real estate (68%), and cash savings (65%).

The research also confirms that recent global challenges have influenced our financial legacy mindset. About two-thirds (66%) of us feel the weight of the world's events, making us even more determined to help our loved ones. At the same time, almost half (45%) of us feel our family expects or feels entitled to our financial legacy and estate.

For those of us who wish to leave a financial legacy, the goals are clear: two-thirds (65%) of us want to help family or loved ones achieve greater financial security, while over half of us (55%) want our wealth to be an expression of heartfelt gratitude and love. Additionally, two in five (40%) of us are focused on helping loved ones break into or get ahead in the property market.

The good news is most (74%) of us have been proactive and have already prepared for this through a Will, ensuring smooth transitions after they pass on. Over a third (37%) of us have started or are planning to transfer our wealth.

In terms of who gets what, children take the lead, with most (82%) receiving assets and belongings before their parents' passing and nearly the same proportion (80%) after.

After children, most (51%) said their spouse or partner is most likely to receive assets and belongings after they pass, with almost one-fifth (18%) receiving some wealth before.

Unfortunately, not all of us feel as confident in the extent of financial support we can provide (23%). In fact, two-fifths (41%) expressed concerns about our ability to afford the wealth we wish to give, while three-quarters (76%) agree it’s becoming increasingly difficult to leave an inheritance with growing financial pressures.

Inherit the heart — a non-financial legacy matters too

When it comes to leaving a legacy, it's not just about the money. In fact, two-fifths (40%) of those who plan to leave a financial legacy would rather be remembered for non-financial contributions.

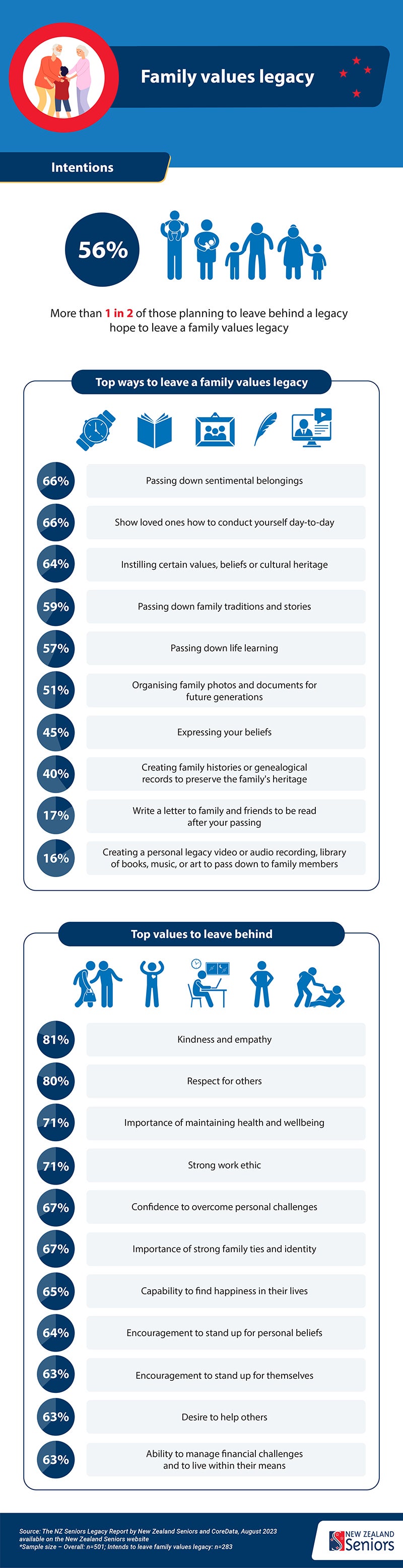

The study shows that more than half (56%) of us aspire to pass down a legacy of cherished family values. This includes sentimental belongings (66%), as well as the values, beliefs, and cultural heritage we hold dear (64%).

Kindness and empathy are values that most (81%) hope to pass on to our families. Respect for others is equally important, with a similar proportion (80%) striving to instil this value. Meanwhile, many of us aim to leave a legacy emphasising the importance of prioritising good health and wellbeing (71%).

For over half of us (56%), leaving a well-rounded impact on the world is more important, as we want to be remembered for both a financial and non-financial legacy.

Of course, for some of us, there are challenges standing in the way of legacy planning that are unrelated to wealth. For example, the fear of not accomplishing enough or not leaving a significant impact on the world is a looming concern for many (29%) of us aged 50–55. Whereas those aged over 80 feel hindered by regret, guilt, and unresolved conflicts (29%).

End-of-life conversations with loved ones

While over half of us (51%) understand that discussing inheritance and end-of-life wishes with our families is crucial, not everyone is eager to have these conversations.

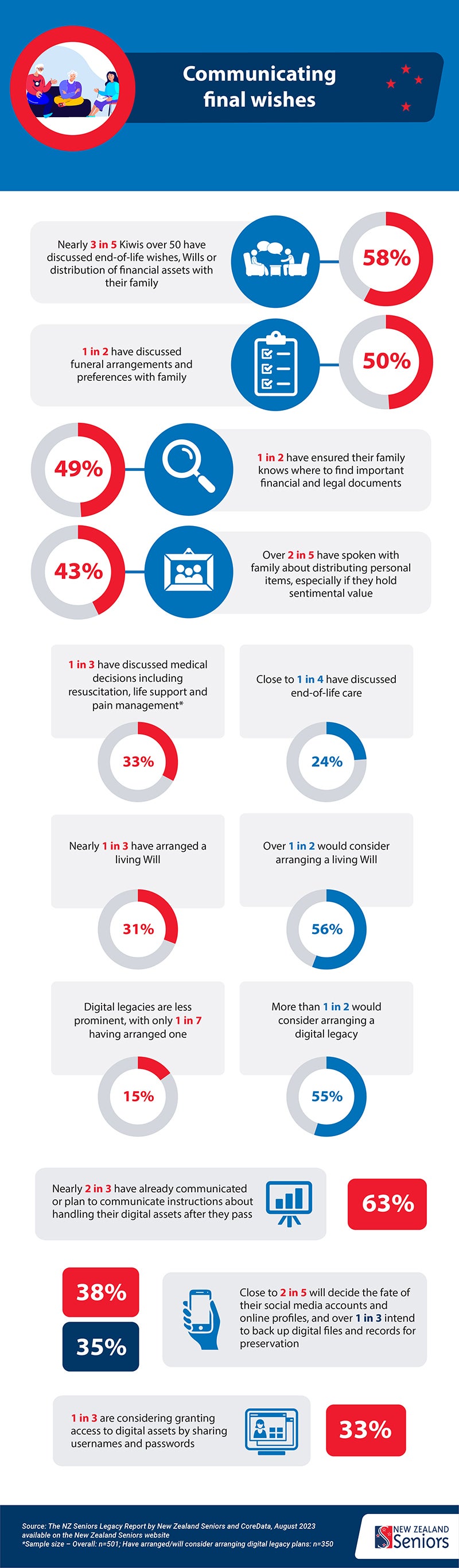

Just under three in five (58%) of us have engaged in family discussions about our Will and the distribution of our financial assets. However, among those of us who have started legacy planning, many (49%) have spoken to family about the whereabouts of important financial and legal documents.

When it comes to funeral arrangements and preferences, half (50%) of us have been forthcoming with our family. And most have also taken the time to discuss wishes and plans with loved ones regarding digital assets after we pass (63%).

However, less than two in five (38%) of us have planned or are planning to decide what should happen with our social media accounts and other online profiles. Even fewer have taken the initiative to back up our digital files and records for safekeeping and preservation (35%).

Ready to plan your Will?

Planning your Will can be a daunting task, but having conversations with your loved ones early in the process and seeking legal counsel can help ensure that your wishes are met. Lawyer, Vicki Ammundsen, who specialises in family law, Wills and estates, shares her three top tips for those wanting to prepare their Will:

- Start early: Conversations regarding mortality and legacy planning can be confronting especially where these are left until later in life. Starting these conversations early with loved ones gives you the space and time you need to express your final wishes clearly.

- Review your Will regularly: Once your Will has been prepared, it’s important to revisit it at least once a decade or sooner when there has been a major life change. This gives you an opportunity to communicate how your wishes, fears, and expectations may change overtime.

- Seek legal support: Seek the support of a lawyer to ensure that your plans and testamentary wishes are correctly recorded with an appreciation of the relevant legal framework.

The information provided in this article is general information and shouldn't be relied upon as legal advice or as a substitute for legal advice. If you have legal questions, you should contact an appropriate professional.

Stay tuned for the next chapter of the New Zealand Seniors Series. Discover more insights in The Legacy Report 2023.

23 Nov 2023